With the increasing exploration interest in Africa, can you give us an insight into key PGS markets, projects and regions?

Over the last 30 years, PGS has been most active in the established markets of Angola, Nigeria and Egypt resulting in significant data libraries and dozens of individual surveys in each country. Today our clients in those markets are also investing in 4D seismic and we are pushing the boundaries of technology to improve imaging in known but complex geological settings. In fact, with processing technology advances we can take an imaging leap forward by combining reprocessed older data with newly acquired data.

Just as important for the longer term is where we invest in new multiclient data in frontier basins. This is guided by our own geoscience team and in cooperation with our government partners. It can take time, but as an example, our investment in 3D in Cote D’Ivoire has proven to be well located to support the industry’s accelerated exploration efforts following the Calao discovery. It is exciting to see how the successes in the deepwater Aptian-Albian play in the Orange Basin are stimulating thinking and investment in similar settings around the continent. With knowledge also gained from analogous discoveries on the other side of the Atlantic, we see a great opportunity for our industry in many countries along the West Africa coast.

How crucial is good quality 3D/4D data to unlocking Africa’s energy resources?

The most recent discoveries in West Africa show us that a combination of good-quality data, new ideas, and a little bravery are critical to unlocking the continent's oil and gas resources. As oil companies explore in deeper water it is more important than ever that drilling decisions are based on the best data possible. Time to first oil is critically important and the industry can no longer afford the extra time for multiple seismic surveys. If a discovery is made, it is very important that development drilling can be planned with the same data.

Many of the most recent African discoveries are a combination of stratigraphic traps or more subtle anomalies on seismic, that don’t leap out from the interpreter’s workstation. In these settings, it is more important than ever that seismic data is of a quality that will allow robust quantitative analysis to illuminate similar prospects. The same can be said for 4D seismic, absolutely critical to stem production decline and where survey repeatability is paramount to enable confidence in planning in-fill wells and injection schemes.

Lastly, it is important to recognise that older surveys can also re-ignite interest in exploring a region! By combining datasets together, as we have done with the development of West Africa MegaSurveys to support basin screening and the systematic reprocessing of data using the latest imaging technology, the industry gains wider basin understanding and new imaging insight in a fraction of the time. Ideal for attracting new investors into a region.

Recent world-class discoveries (orange) that demonstrate the potential, and the number of exciting prospects to be drilled (blue).

How many surveys has PGS carried out in Africa in total?

PGS acquired our first seismic survey in Africa in 1994. It was a 3D MultiClient project in Nigeria, with our newest vessel the Atlantic Explorer towing what was then a state-of-the-art 6-streamer spread.

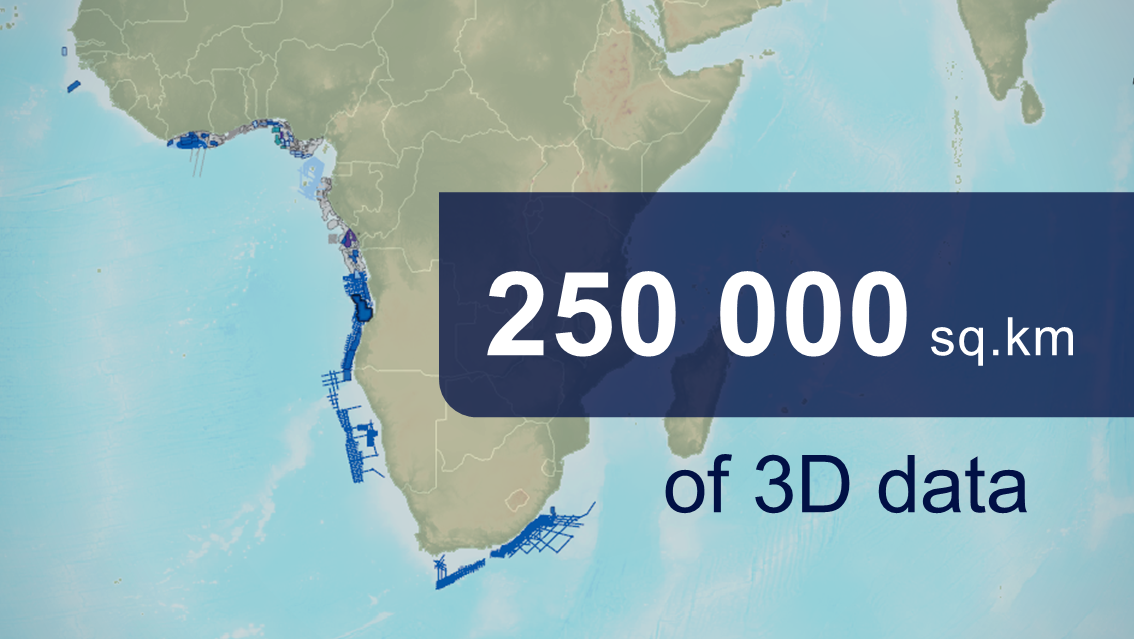

In the intervening 30 years, we have acquired over 250 surveys around the continent. Of those, 25% were acquired as MultiClient projects resulting in close to 250 000 sq. km of 3D and 75 000 line km of 2D available for licensing and the proprietary surveys combined cover a significantly larger area. The PGS seismic acquisition technology has advanced to the point that we now routinely tow five times as many kilometers of streamer and spreads that are five times as wide as that first survey in the Niger Delta.

PGS has a long and illustrious history in Africa. Can you give us an insight into PGS’ journey on the continent, from the pioneering work such as the first 3D GeoStreamer in West Africa to now?

The 1994 Nigerian MultiClient survey I referred to earlier was PGS’ first investment in seismic outside of the North Sea and within the first year of our foray into the MultiClient business. We have frequently showcased new technology advances in Africa first, which speaks volumes to our confidence in the markets and also the attitude and support of our government and oil company partners.

As examples, our first GeoStreamer 3D project was in Congo in 2009, we acquired a Simultaneous Long Offset (SLO) project in Ghana as early as 2012, acquired ground-breaking WAZ surveys offshore Angola in 2009 and deployed spreads as wide as 1 800 m in South Africa to maximize acquisition efficiency using our Titan-class vessels. Multicomponent GeoStreamer data has proven critical not just for imaging quality but our ability to tow deeper has ensured continuous acquisition and uncompromised data quality despite the often-harsh African operating environment. Technology has also helped us stay on top of increasing environmental challenges such as the increase in barnacles offshore Africa. We have developed a unique ROV-deployed streamer cleaning device and a PGS streamer coating system to inhibit barnacle build-up and our research continues.

In more recent times, we have worked closely with clients to develop acquisition configurations to solve deeper and more complex imaging challenges. Around Africa that has included the use of multiple source vessels, considering wide-tow source configurations and the use of extended frequency sources. PGS completed the first commercial seismic survey to use the Gemini Source in 2022 in African waters and has undertaken more projects since.

What is unique about the PGS capability and the PGS team?

The PGS core values are ‘Dedicated. Reliable. Pioneer’, and I believe all these aspects of our company’s character are demonstrated in our work in Africa.

As the statistics above demonstrate, we have certainly focused and led the seismic industry in many parts of the continent and this is, in no small part, down to the dedication of our employees based in Africa. We are rightly proud to build local presence and support local industry development in the places where we have benefited as a company.

We are also proud that our clients return to working with PGS time and time again and though there are many factors in their decision making, we are confident that our ability to deliver data quality on time is important to them. In harsh operating environments and with time pressures, we believe our ability to operate safely and deliver data on time is a winning combination.

I have already commented on technology firsts in Africa, but worth highlighting that relentless innovation isn’t just about acquisition technology and safe operations and imaging advances, but it also includes new ways of working. We are constantly reviewing business models, fuelled by the inherent flexibility of our data in the Cloud and by the opportunities afforded by new satellite technology and what it could mean for data management and delivery from our vessels. I am sure that thirst for innovation won’t change.

What will the TGS-PGS merger deliver for the African continent and how will this benefit the unlocking of Africa’s energy resources in a tightening global market for exploration dollars?

The TGS-PGS merger will establish a robust business with complementary technologies, complementary seismic data libraries and a solid balance sheet, all of which can support the energy industry in Africa. We will have more bandwidth to support data sales, a stronger geoscience team to promote prospectivity and help focus MultiClient investment, and the potential combination of streamer and node acquisition will help unlock some of the more complex geological challenges.

In a tightening market for exploration dollars, it is critical for the continent’s success, that we attract new companies to explore. PGS and TGS have similar philosophies to how to support our government partners in promoting opportunities and we are certainly aligned on the importance of the industry growth in Africa. Together we will be a formidable advocate for African oil and gas development.

How does the PGS team feel about the future of E&P in Africa?

The PGS team are quietly confident that we are moving into the age where E&P in Africa is accelerating. That is firstly fuelled by the obvious demand on the continent for cost effective and reliable energy, but also because of the increasing realism about the timing of the energy transition and the longer term need for hydrocarbon production. Provided the industry is open to investment from new players and we do everything in our power to make it easy and transparent to invest, then we can look forward to substantial growth for the E&P industry in Africa!